Lagos Matters

Lagos Assures Investors Judicious Use of N100bn Bond

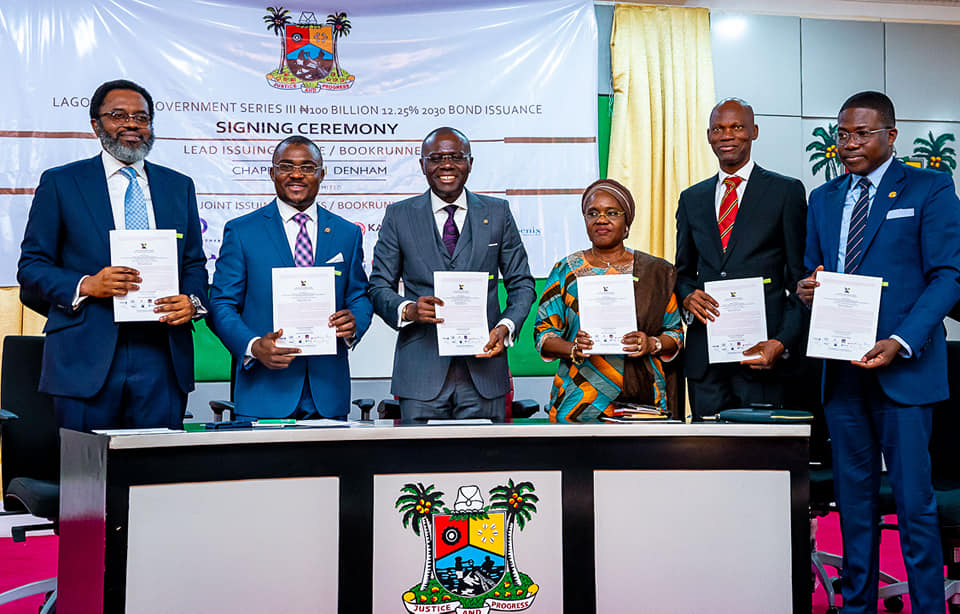

Governor of Lagos State, Mr Babajide Sanwo-Olu, on Wednesday, January 29 signed documents for the issuance of N100.33 billion bond, which was raised from capital market to fund infrastructure and ongoing projects in the state.

The signing ceremony which took place at the State House in Alausa, featured investors and issuing parties present when the governor signed the over-subscribed Series III Bond Issuance of N100 billion, which was issued and raised by the state under its N500 billion bond Programme approved four years ago.

Speaking at the event, the governor said the financial intervention was important to the Lagos economy, saying it is the largest bond programme ever embarked on by any state in the country.

“We have embarked on a new journey that is not meant to serve our personal interest, but to activate more prosperity for our dear Lagos and give our people the hope for better tomorrow we all dreamed.

“When we came into government, we made commitment to all Lagosians that we are coming to pursue and implement an agenda that will build our capacity to achieve Greater Lagos we all will be proud of.

“Today, I am standing in from you all to say we are writing the financial history of Lagos in another chapter and it will bring good dividends to all residents. With this N100 billion bond, we will ensure that all Lagosians feel the direct impact of this intervention in their homes and on the roads.

“We are bringing new infrastructure and repairing the existing ones, including bridges and hospitals. We are going to renovate schools and build new ones for our children; slums will be regenerated and pressing environmental issues will be solves. We are going to make people feel the essence of governance.”

Mr Sanwo-Olu recalled that the effort to raise the bond started three months ago with a simple discussion with professional partners led by Chapel Hill Denham, which worked effortlessly to ensure that the statutory period recommended by Securities and Exchange Commission (SEC) to raise such bond was met.

The Governor applauded the efforts made by partners to secure essential requirements to access the capital for the bond, which involved the reduction of the state’s interest expense by N17 billion, giving the state the opportunity to raise the bond from the capital market.

“Less than three months down the line, we are celebrating the biggest sub-national bond issuance today and the team of partners has also helped us to restructure our entire balance sheet.

“We have been able to revert the entire borrowing of Lagos from very high rate to acceptable numbers. The team has also helped us to reduce interest expense by N17 billion, which made it easy for us to approach the financial market,” he said.

Mr Sanwo-Olu assured investors who subscribed to the N100 billion bond that the funds would be disbursed strictly to finance infrastructural projects required to boost Lagos State’s economy.

-

Society News3 years ago

Jamaican man beheads wife after finding out their 6 kids are not his

-

Society News5 years ago

EXCLUSIVE: The Complete Story of Dolapo Awosika, John Fashanu and Prophet Kasali Sex Mess

-

News2 years ago

Breaking: Ex-Police IG, Tafa Balogun Dies

-

News4 years ago

Pastor Osagie Ize-Iyamu, His Membership Of Secret Cult, And Other Issues Touching On His Public Credentials Examined by Barr. PATRICK I. BIOSE

-

News4 years ago

BREAKING: Ajimobi’s daughter-in-law blast Gov. Makinde, says gov can’t surpass ex-Oyo gov

-

News4 years ago

BREAKING: 2 arrested as NAF begins investigations into Tolulope’s death

-

News4 years ago

BREAKING: Police take over Edo House of Assembly as APC, Oshiomhole move to seize control

-

Crime4 years ago

Exclusive: Female Aide Fingered In Oko Oloyun’s Murder + Banking Transactions That Nailed Husband

Notice: Undefined variable: user_ID in /var/www/first2023/wp-content/themes/firstweekly/comments.php on line 48

You must be logged in to post a comment Login